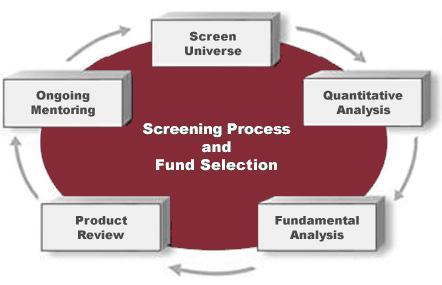

Our rigorous investment process is designed to pursue results.

We apply state-of-the-art investment concepts and deep experience to your investment strategy.

How do you manage money?

We manage money thoughtfully on a fee-based fiduciary basis. There are no sales charges or commissions on our managed investment accounts. Our research is a collaboration of the best ideas from a vast resource of independent minds and companies.

What is your investment philosophy?

We believe that goals must always inform investment strategy, that capital preservation is always key, and that diversification and rebalancing are powerful and necessary tools. We believe that markets provide opportunities for value-creation through active management, and that a big part of our job is to help you stay the course, without being distracted by short-term market ‘noise’.

How do you manage portfolios?

We believe there are four main processes involved in managing a portfolio; portfolio design (sometimes called strategic asset allocation), tactical asset allocation, individual investment selection, and ongoing rebalancing.

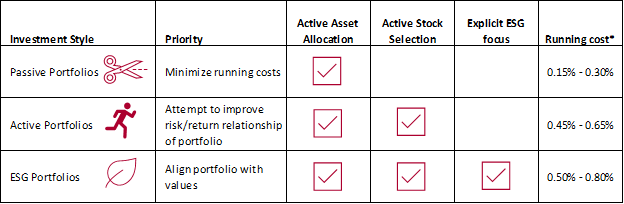

What styles of portfolios do you offer?

All Harvest portfolios are multi-asset in nature and global in scope. They’re built primarily with no-transaction-fee mutual funds. Within that paradigm, we offer three portfolio ‘styles’: Active, Passive, and Environmental Social and Governance (ESG) oriented. By choosing amongst these three approaches, we can customize the cost, level of activeness, and social orientation of your portfolio.

What is asset allocation?

Historically, asset categories such as different types of stocks and bonds, correlate to each other in diverse manners. We create base models from historical methods and overweight and underweight different sizes, types, and geographic locations of stocks and bonds depending on market conditions.

How do you select your investments?

We use a combination of passive and active investment holdings to help create a diverse portfolio. Our independence and fiduciary status allow us to be completely objective when selecting the best investments for our clients. Key considerations include the degree of fit with your portfolio, cost, and potential for value-add.

How do you rebalance?

We believe the best way to rebalance is not time-based, but volatility-based. When volatility occurs and stocks go up or down, we stay committed to our models. We establish thresholds for your portfolio’s drift from its original allocation and are notified daily if any of your positions need to be rebalanced back to their intended weights. This allows us to consistently sell high and buy low within our portfolios.

Do you have a dedicated investment team?

We believe in collaborating with many different strategic partners to pursue results for our clients. Our investment committee, which is comprised of Harvest Wealth Management advisors, our Chief Investment Officer, and advisors and CFAs from other respected firms, meets quarterly to discuss regulatory, economic, and investment trends. We also consult with the 22-person research team at Commonwealth, our broker/dealer partner.

Our bench is deep and experienced because your investments are important.